x

G

o

l

d

F

i

- By Admin

- January 3, 2025

Why More Americans Are Turning to Digital Gold in 2025

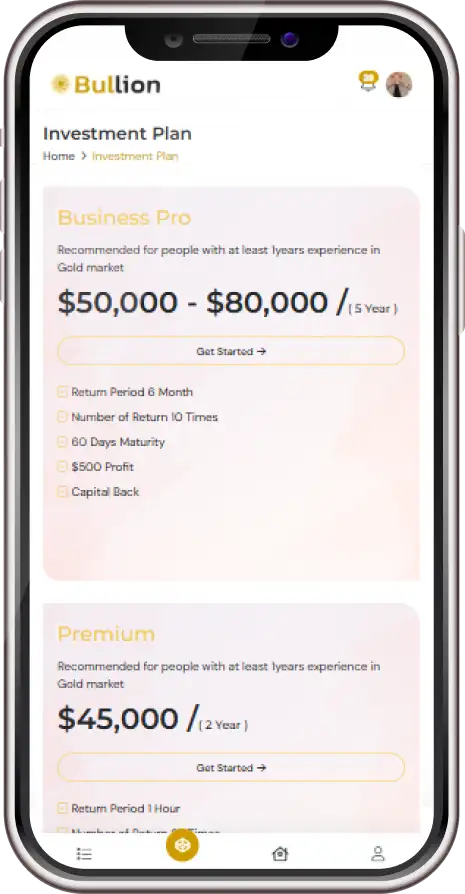

In uncertain times, one asset has consistently proven its value: gold. But as technology reshapes finance, the way Americans invest in gold is evolving. In 2025, more individuals are choosing digital gold platforms over traditional dealers and ETFs — and for good reason.

Here's why digital gold is becoming the new gold standard for U.S. investors.

1. Accessibility: Gold for Everyone

Gone are the days when gold investing was only for the ultra-wealthy. With platforms like GoldFi, everyday Americans can now:

Start investing with as little as $50

Buy gold 24/7, anytime, anywhere

Skip the paperwork, middlemen, and delays

Digital gold is inclusive, instant, and mobile-first.

2. Security That Matches Wall Street

At GoldFi, your gold is:

100% allocated – you own specific ounces

Stored in fully insured U.S.-based vaults

Protected by independent third-party audits

This means you own real, physical gold — not just a number on a screen.

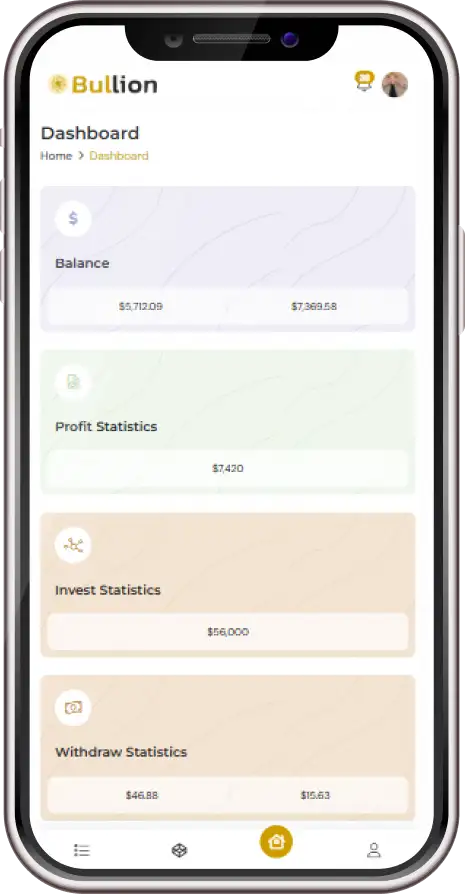

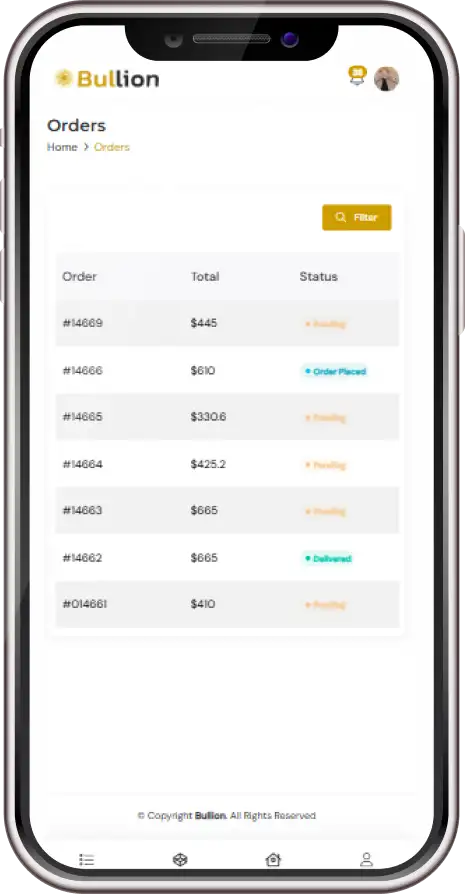

3. Technology That Puts You in Control

With a secure app interface and real-time tracking, investors now have:

Full visibility of their gold holdings

Access to buy, sell, and transfer instantly

Transparent transaction history and market pricing

GoldFi combines the trust of gold with the power of fintech.

4. A Hedge for American Investors

With inflation concerns and global instability, U.S. citizens are increasingly turning to gold to protect their dollar-based savings.

“Digital gold isn’t just convenient — it’s essential for financial independence.”

— Mark R., GoldFi user from Dallas, TX

Final Thoughts: Real Gold. Real Ownership. Zero Friction.

Gold is no longer just a legacy investment — it’s a digital asset you can control.

Whether you're saving for retirement, hedging against inflation, or simply diversifying, GoldFi makes owning gold secure, affordable, and modern.

Tags: #GoldInvestment #DigitalGold #GoldFi #FinancialFreedom #USInvestors #RealGold #WealthProtection